CBA Issues Call to Action: Fintechs Must Abide By Consumer Protection Laws, Assume Federal Supervision

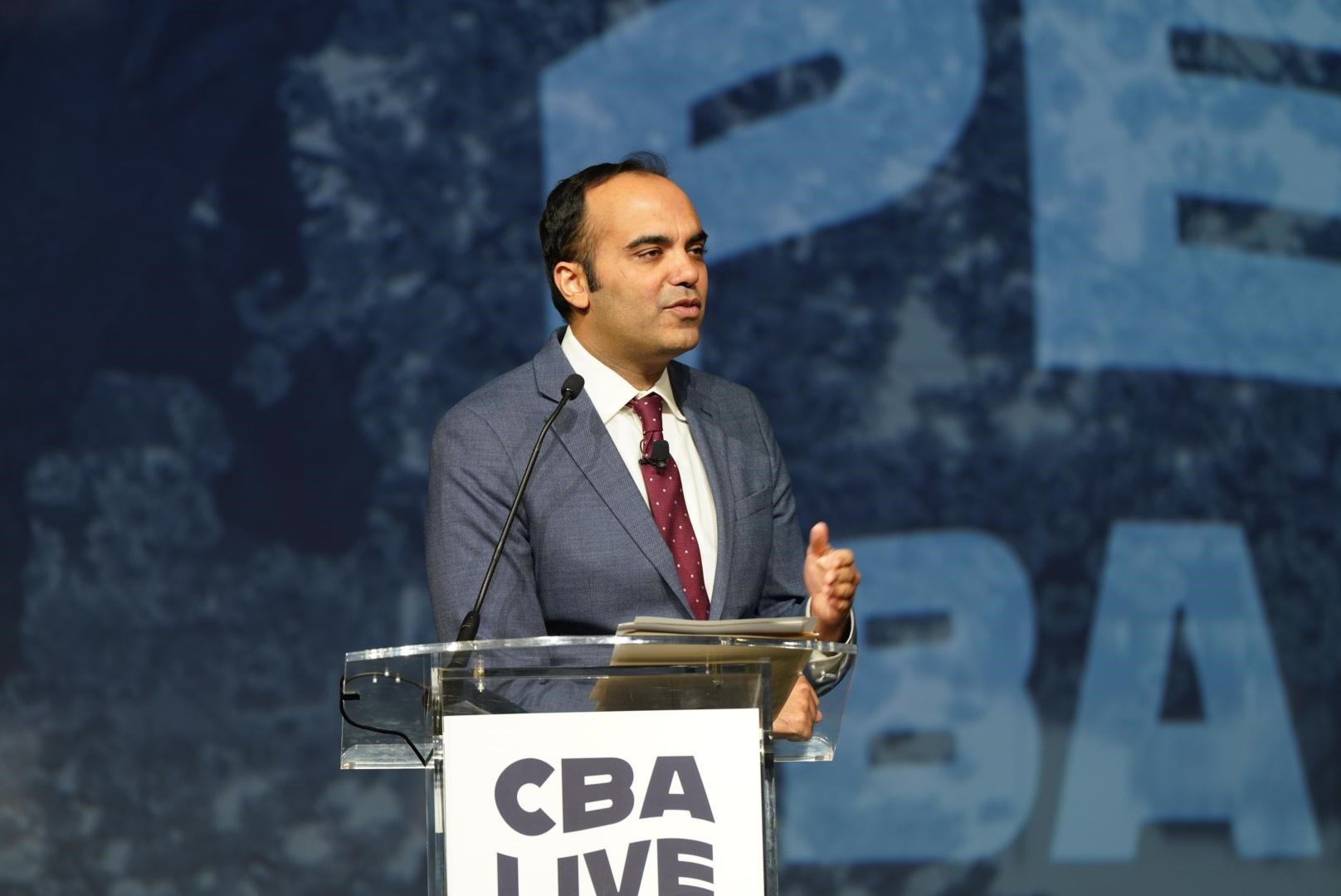

Consumer Bankers Association (CBA) President and CEO Richard Hunt today opened retail banking’s premier annual event, CBA LIVE 2022, acknowledging how much the banking industry and regulatory environment have evolved since CBA LIVE first began 13 years ago, specifically highlighting how the rapid emergence of fintech companies has left millions of consumers without the protections they’ve come to expect from traditional banks.

Recognizing “nothing moves quickly in Washington, D.C.,” Hunt issued a call to action to fintech companies offering banking services and products:

“We always welcome competition in our industry, but if a fintech is going to offer banking products, they ought to be regulated as a bank. They should have the same rules as every other (federally supervised financial institution) in this country. Congress and regulators must move swiftly to make sure there's a level playing field across the banking landscape. But newsflash, nothing happens quickly in Washington, D.C., whether on the regulatory or legislative side.

“Therefore, today we’re calling on fintechs to voluntarily accept all consumer protection laws and assume federal oversight from the CFPB and all the other [regulatory] agencies. […] [Fintechs] also have a responsibility to invest in every community across this country and they should adhere to all CRA obligations as well.”

Following Hunt’s opening address on Monday afternoon, Dimitrios Lagias, Managing Director & Partner at Boston Consulting Group (BCG) delivered “How To Win The War For Talent,” offering key insights and industry analysis on how leading banks can attract and retain employees in this highly competitive labor market. Summarizing his message to CBA LIVE 2022 attendees, Lagias said:

“The war for talent is real, hybrid models are here to stay, and the most successful financial institutions will be those who keep an open mind. Getting it right requires rethinking the way we do things and lots of experimentation.”

With so many wondering what the future of the workplace will look like in this new environment, CBA LIVE 2022 attendees were asked to vote on their predictions for how many days they anticipate being in the office in years to come. Overwhelmingly, their responses confirmed Lagias’ belief most banks will operate in a hybrid model:

Michelle Lee, CBA Board Chair and Head of Regional Banking at Wells Fargo, agreed, noting the challenges with retaining talent:

“We’ve got to think differently for our employees. […] I think about some of the ways we tried to combat the turnover that we were seeing and it was, ‘well, let’s dust off some of the things that we used to do before the pandemic. And some of those things work – from those engagement, onboarding, and connection conversations. I think those things are important. But I think what I learned from [Dimitrios today] was, you’ve got to rethink and reimagine [to tackle this issue].”

In a conversation with Lee, Hunt highlighted Lee’s extraordinary 38-year career in banking and recognized Lee as the first African American Board Chair since CBA was first established 103 years ago.

Reflecting on the progress the industry has made when it comes to advancing diversity, equity, and inclusion and noting there is still more work to do, Lee said:

“I think back to when I started as a teller, I was the first African-American teller in Livingston, New Jersey, in that branch. And here I am, 30 years later, and I'm still the first. So, you know, the playing field feels a lot different than it did 38 years ago. And I think there’s a lot that has changed. But I think the real question we have to ask ourselves is has enough changed and is it changing fast enough. So, for me, I get it. [Becoming Board Chair] is bigger than me, and it’s an honor.”

She added:

“I think I think we have to acknowledge where we are [as an industry] and the role that we all play....

Lee also recognized how CBA’s Board of Directors has changed, noting:

“[This board] is the most diverse board yet. […] even more so than when I started seven years ago. The board looks a lot different and from an ethnicity standpoint, a gender standpoint, a generational standpoint. It's a good mix of people, backgrounds, history, and perspectives, and I think it shows.”

Background:

After nearly three years, retail banking’s top annual event, CBA LIVE, has returned. Entering its 13th year, CBA LIVE attracts the top leaders and influencers from across the country who have gathered to discuss the most pressing issues facing the industry, from navigating the new CFPB to tackling the war for talent. With more than 70 hours of dynamic programming and 14 forum sessions tailored to different bank segments, CBA LIVE offers top-notch programming for professionals motivated to learn new trends and share ideas with the most influential decision makers in the business. For those unable to attend CBA LIVE this year, be sure to watch key moments via the CBA LIVE Stream by clicking HERE.