CBA Applauds Dept. of Education for Pro-Student Financial Aid Recommendations

CBA Applauds Dept. of Education for Pro-Student Financial Aid Recommendations

WASHINGTON – The Consumer Bankers Association (CBA) today commended the Department of Education’s new recommendations for changing the way schools advise prospective and current students about financial aid. The Department’s announcement, via the Information for Financial Aid Professionals system, includes many of the recommendations CBA has made over the past few years as part of a “Know Before You Owe” initiative.

“For many families and students, a higher education will be one of the most costly investments they make. Colleges and universities have an obligation to set students up for success and the Department of Education should be commended for its recommendations to help ensure students know the true cost of their education. Every student should know how much money they are borrowing and how they will be responsible for repaying. For far too long, it seems some institutions of higher education have tried to mask these key factors by combining grants and scholarships with loans, work study programs and parent loans,” said CBA President and CEO Richard Hunt.

“These recommendations address one problem with our higher education financing system, but Congress must act legislatively to require these recommendations are followed as well as to reform the federal student loan program – the true driver of skyrocketing student debt and tuition increases.”

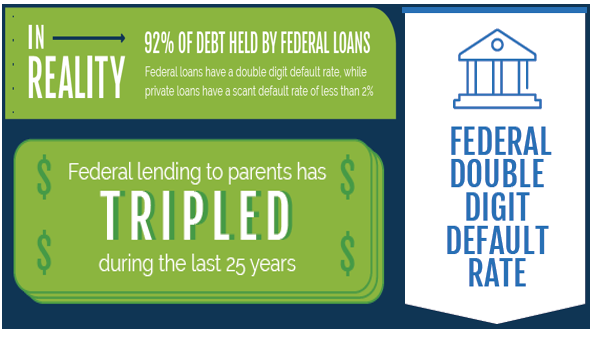

In the last decade, American student loan debt has gone from $600 billion to $1.5 trillion. About 92 percent of that debt is from the federal government and those federal student loans have a double-digit default rate compared to a 98 percent repayment rate for bank-issued student loans.

To ensure the federal government responsibly serves those most in need while also fully using the capabilities and expertise of the private sector to serve the marketplace, CBA has recommended the follow measures:

- Increasing the availability of Pell Grants.

- Ending unlimited PLUS loan borrowing to help reduce tuition increases.

- Implementing “Know Before You Owe” disclosures to clearly explain the terms of federal loans.

- Renaming so-called “Award” letters provided by colleges to the more accurate “Financing” letters and having them clearly differentiate loans from grants and scholarships.

- Requiring school certification of private education loans.

- Utilizing economist-preferred fair value accounting to show the true cost of federal student loans.

- Requiring detailed public reports on performance of the federal government’s direct loan portfolio.

CBA conducted a poll of 1,000 registered voters this year gauging Americans’ attitudes about student loans and student debt. Among the findings, 90 percent believed loans should carry clear, personalized, plain-language disclosures like those already offered on private loans and nearly 85 percent support placing responsible caps on federal loans to offer access to a quality education without setting up a debt trap post-graduation.

Learn more about CBA’s student lending reform recommendations here and recent polling data here.

###

About the Consumer Bankers Association:

The Consumer Bankers Association represents America’s leading retail banks. We promote policies to create a stronger industry and economy. Established in 1919, CBA’s corporate member institutions account for 1.7 million jobs in America, extend roughly $4 trillion in consumer loans and provide $275 billion in small business loans annually. Follow us on Twitter @consumerbankers.