CBA Launches New Campaign To Protect Consumers From Political Attacks On Their Credit Cards

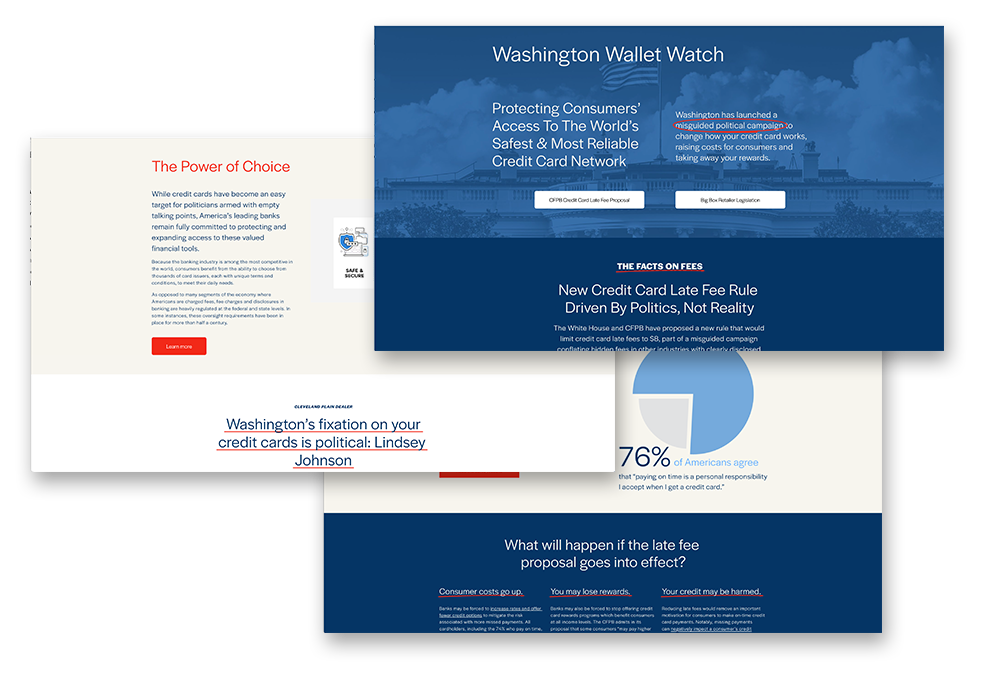

The Consumer Bankers Association (CBA) today announced the launch of the “Washington Wallet Watch” campaign to defend and protect consumers’ access to the world’s safest and most reliable credit card network. Specifically, the campaign will outline how two proposals in Washington would dramatically disrupt the credit card landscape: the CFPB’s imminent final rule to lower credit card late fees and legislation on Capitol Hill that would establish an unnecessary and unsafe federally-mandated payment network.

Commenting on the launch of the “Washington Wallet Watch” campaign, CBA President and CEO Lindsey Johnson said:

“Americans rely on credit cards to pay bills and earn rewards now more than ever. Despite this fact, Washington politicians are seeking to “fix” a credit card system that isn’t broken by advancing ideologically driven policy proposals devoid of facts or reality. This is especially evident in the CFPB’s credit card late fee rule, which would raise costs and restrict access for the millions of American households and small businesses that use credit cards to make ends meet, pay for emergency expenses, and cover the costs of everyday purchases. As the voice of America’s leading retail banks in our nation’s Capital, this campaign reflects CBA’s firm commitment to convey the facts, correct misinformation, and ensure our members remain well-positioned to continue delivering on their mission across every community they serve.”

The new campaign, which includes a new microsite as well as planned earned and paid amplification over the coming weeks, is intended to highlight the threats posed by these proposals to consumers and policymakers alike.

Among other resources, the microsite – www.WashingtonWalletWatch.com – includes:

- An op-ed by CBA President & CEO Lindsey Johnson published in the Cleveland Plain Dealer outlining how Washington’s attack on credit cards would directly harm the millions of Americans who utilize and deeply value the product.

- A recent CBA letter to the U.S. Senate Subcommittee on Financial Institutions and Consumer Protection reiterating opposition to the Biden Administration’s ongoing effort that misrepresents well-regulated bank fees, including credit card late fees.

- Polling data commissioned by CBA which found that a majority of Americans appreciate the personal responsibility associated with on-time credit card payments and don’t believe these fees constitute “junk.”

- In addition, the Washington Post debunked several claims included in the CFPB’s proposal to lower credit card late fees, calling the agency’s calculations “fuzzy math.”