How The CFPB Can Bolster Protections For Consumers In The Digital Payments Market

What’s Happening

The financial services ecosystem has rapidly evolved over the past decade, driven largely by the growth of fintechs and other non-bank entities increasingly offering products and services that have traditionally only been offered by well-regulated banks. This is especially true today in the peer-to-peer (P2P) payments market, which is largely controlled by fintech companies like Venmo and CashApp, in contrast to bank provided P2P services, such as Zelle. Recognizing these firms are not held to the same stringent federal oversight standards as bank provided P2P services, such as Zelle, the Consumer Financial Protection Bureau (CFPB) is expected to initiate a larger participant rulemaking to extend its supervisory authority to non-bank P2P companies.

Why It Matters

Over the past ten years, consumers have increasingly been using P2P companies such as Venmo to send and receive money and make online purchases. In 2021, about seventy six percent of Americans had used P2P payment platforms. In 2022, fifty three percent of individuals who used mobile payment apps are using them to pay for online purchases. What consumers might not be aware of is that these P2P companies are not protected or regulated in the same way as depository institutions and credit cards issuers are.

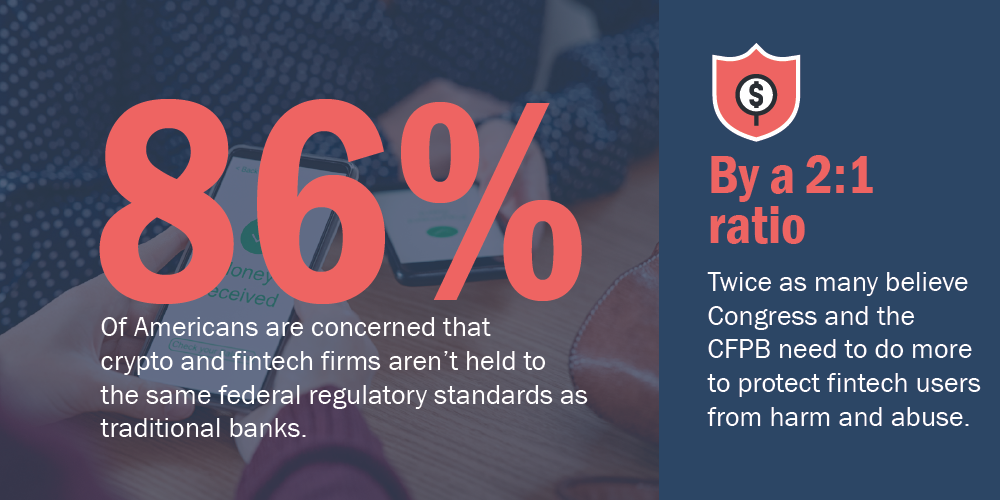

- A 2022 CBA survey found the vast majority of Americans (86%) are concerned that crypto and fintech firms are not held to the same federal regulatory standards as traditional banks. By a 2:1 margin, they also believe Congress and the CFPB need to do more to protect fintech users from harm and abuse.

In June, the CFPB issued a consumer advisory for customers of these platforms, highlighting the fact that their funds may not be protected in the event of financial distress as they are not federally insured in the same manner as deposits at a bank. Specifically, CFPB Director Chopra said:

"Popular digital payment apps are increasingly used as substitutes for a traditional bank or credit union account but lack the same protections to ensure that funds are safe. As tech companies expand into banking and payments, the CFPB is sharpening its focus on those that sidestep the safeguards that local banks and credit unions have long adhered to."

In light of the continued growth of the digital payment market and the risks posed to consumers by fintech P2P providers, policymakers have a responsibility to ensure a level-playing field and ensure consumers receive the same financial protections whether they choose to send money through their bank or through a nonbank fintech.

Dive Deeper

Under the Dodd-Frank Act, the CFPB has authority to supervise nonbank entities considered to be “a larger participant of a market for other consumer financial products or services.” The CFPB has previously utilized this authority to issue rules allowing for CFPB supervision of “larger participant” nonbanks in the consumer reporting, consumer debt collection, student loan servicing, and international money transfers markets. By issuing a larger participant rule for fintech firms in the consumer payments market, the CFPB can oversee and supervise these nonbanks to ensure they comply with applicable law and consumers are protected.

What We’re Saying

Every consumer deserves the highest level of protections, and CBA is pleased to see the CFPB take this step to supervise nonbanks in this space. CBA has advocated for the CFPB to take such action in the past, including writing a letter to CFPB Director Chopra in 2022, urging the CFPB to supervise the nonbanks in the unsecured consumer lending, payment processing, and data aggregations markets.

CBA and the Center for Responsible Lending (CRL) also wrote a joint petition to the CFPB, highlighting the importance of promoting responsible lending practices through regulation:

“CRL and CBA share a common belief that the absence of a rule defining larger participants in the market for personal loans has created an unlevel playing field and a large risk to consumers that the Bureau can and should resolve through a larger participant rulemaking.”

The Bottom Line

The importance of innovation in financial service offerings and products to meet the needs of consumers and to maintain America’s financial competitiveness cannot be overstated. But neither can the importance of transparency, market stability, and consumer protection. CBA commends the CFPB for taking steps to mitigate potential harm to and abuse of consumers in the P2P market and stands ready to assist in this effort in the coming weeks.