press release

CBA Responds to Latest Misleading Narrative from CFPB on Competitive Credit Card Marketplace

Weston Loyd

Consumer Bankers Association (CBA) President and CEO Lindsey Johnson today responded to the latest misleading narrative from the Consumer Financial Protection Bureau (CFPB) related to the robustly competitive credit card market:

As the CFPB’s 2017 “Becoming Credit Visible” research shows, credit cards serve a uniquely important role in financial inclusion, by bringing “credit invisible” consumers into the marketplace. Working with deep subprime consumers, however, requires charging higher interest rates, given banks’ safety and soundness obligations and the higher risk of default.

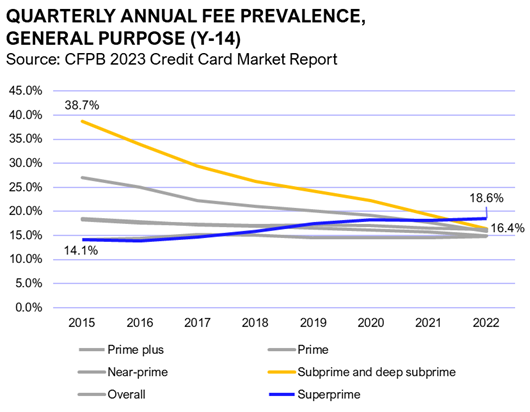

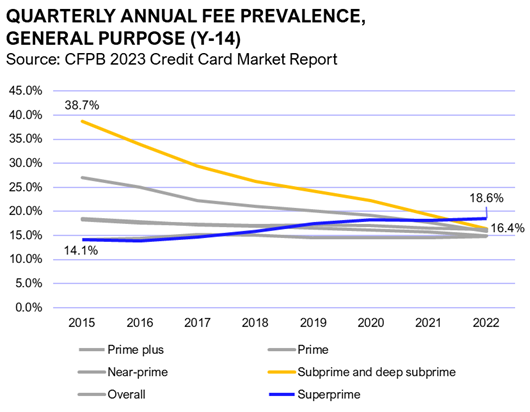

Over the same time period, credit card issuers have cut the prevalence of charging annual fees to subprime and deep subprime consumers by more than half (see the below chart, which CBA created using data from the CFPB’s 2023 CARD Report). This shift away from annual fees for subprime and deep subprime populations does move more of the credit card pricing components “up front” to the credit card interest rate. But that, presumably, should benefit cardholder competition, but giving consumers a single number to compare credit cards against.

As the CFPB’s 2017 “Becoming Credit Visible” research shows, credit cards serve a uniquely important role in financial inclusion, by bringing “credit invisible” consumers into the marketplace. Working with deep subprime consumers, however, requires charging higher interest rates, given banks’ safety and soundness obligations and the higher risk of default.

Over the same time period, credit card issuers have cut the prevalence of charging annual fees to subprime and deep subprime consumers by more than half (see the below chart, which CBA created using data from the CFPB’s 2023 CARD Report). This shift away from annual fees for subprime and deep subprime populations does move more of the credit card pricing components “up front” to the credit card interest rate. But that, presumably, should benefit cardholder competition, but giving consumers a single number to compare credit cards against.

The CFPB’s recent blog post warns that these recent changes “may push consumers into persistent debt,” yet the CFPB’s 2023 CARD Act Report also addresses persistent debt and finds that rates of persistent debt are lower than each and every pre-pandemic year.

The CFPB’s recent blog post warns that these recent changes “may push consumers into persistent debt,” yet the CFPB’s 2023 CARD Act Report also addresses persistent debt and finds that rates of persistent debt are lower than each and every pre-pandemic year.

“The CFPB claims that rising credit card interest rates over the past decade have been against a background of a ‘relatively stable share of cardholders with subprime credit scores.’ This simply isn’t true. The CFPB’s 2023 CARD Act Report explains that ‘as of year-end 2022, cardholding by adults with deep subprime credit scores was at its highest level since at least 2013.’ “The CFPB continues to extend beyond its consumer protection authority to pose questions about setting pricing and profits. At best, those are questions about politics – not bank policy. “Further, the CFPB continues to double-down on its false narrative about the state of competition in the credit card market. CFPB data shows the market share of the top ten issuers continues to decline. But more importantly, try naming any other market that has 10 major participants: 10 auto manufacturers; 10 cellphone manufacturers; 10 internet service providers; 10 pizza delivery chains – much less 4,000 options that consumers can obtain by visiting a website on their smartphones. “CBA and our members support strong consumer protection regulation. We believe, however, for the market to operate effectively, American consumers need a regulator that heeds the limits of its statutory authority and represents facts accurately.”

Background Information

The CARD Act Report appears to show the proportionate growth in overall credit card fees is attributable to, among other causes, the increased availability of credit for lower-scored consumers, as well as a transition away from annual fees for those consumers.

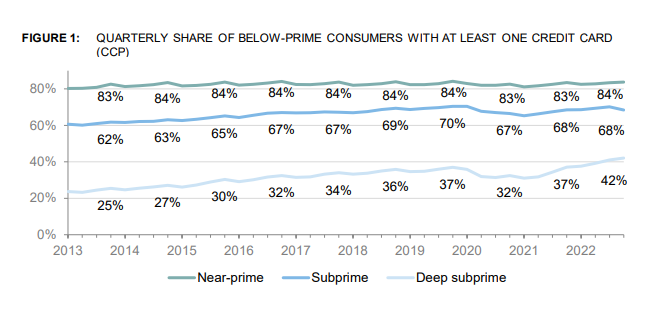

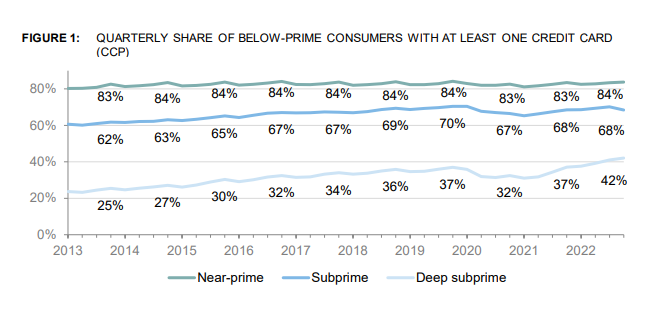

As shown in Figure 1, from the CFPB’s October 2023 CARD Act Report, the share of deep subprime consumers with a credit card has actually grown 17 percent since 2013. Similarly, the proportion of cardholders under the age of 25 years old – those with less credit history – has grown 10 percent. As the CFPB’s 2017 “Becoming Credit Visible” research shows, credit cards serve a uniquely important role in financial inclusion, by bringing “credit invisible” consumers into the marketplace. Working with deep subprime consumers, however, requires charging higher interest rates, given banks’ safety and soundness obligations and the higher risk of default.

Over the same time period, credit card issuers have cut the prevalence of charging annual fees to subprime and deep subprime consumers by more than half (see the below chart, which CBA created using data from the CFPB’s 2023 CARD Report). This shift away from annual fees for subprime and deep subprime populations does move more of the credit card pricing components “up front” to the credit card interest rate. But that, presumably, should benefit cardholder competition, but giving consumers a single number to compare credit cards against.

As the CFPB’s 2017 “Becoming Credit Visible” research shows, credit cards serve a uniquely important role in financial inclusion, by bringing “credit invisible” consumers into the marketplace. Working with deep subprime consumers, however, requires charging higher interest rates, given banks’ safety and soundness obligations and the higher risk of default.

Over the same time period, credit card issuers have cut the prevalence of charging annual fees to subprime and deep subprime consumers by more than half (see the below chart, which CBA created using data from the CFPB’s 2023 CARD Report). This shift away from annual fees for subprime and deep subprime populations does move more of the credit card pricing components “up front” to the credit card interest rate. But that, presumably, should benefit cardholder competition, but giving consumers a single number to compare credit cards against.

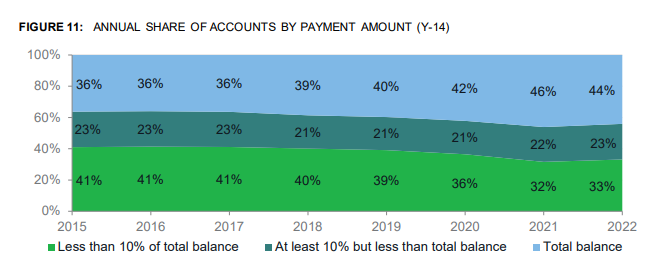

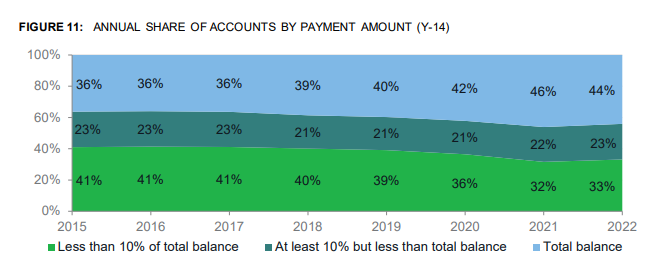

The CFPB’s CARD Act Report shows more consumers are paying their credit card balances off each month than in prior years.

Importantly, data from the CFPB’s CARD Act Report shows credit card issuers have been able to bring these higher-risk consumers to market while simultaneously making material improvements in how consumers fare with their cards on a day-to-day basis. The CFPB’s CARD Act Report shows that 44 percent of consumers are paying off their total balances in full – up from 36 percent in 2015.

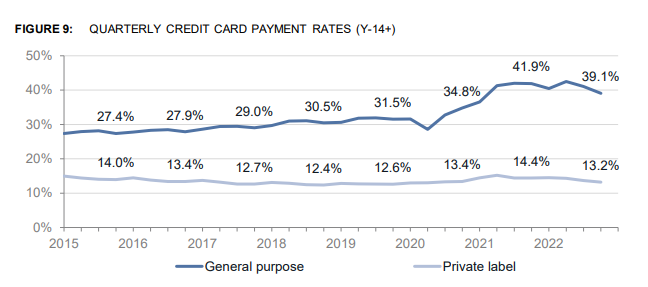

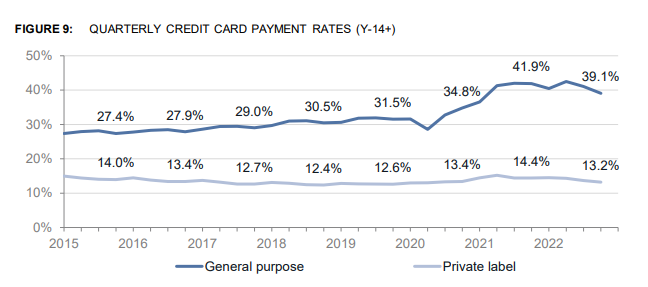

Consumers are paying down a higher share of credit card balances, reducing their debt burdens.

Further, consumers are paying off 39.1 percent of their credit card balances – up from just 27.4 percent in 2015. The progress was so remarkable the CFPB’s CARD Act Report specifically notes, “Consumers tend to display consistent transacting and revolving activity over time, which makes the shifts in repayment behavior observed in recent years particularly notable” (p.38). The CFPB’s recent blog post warns that these recent changes “may push consumers into persistent debt,” yet the CFPB’s 2023 CARD Act Report also addresses persistent debt and finds that rates of persistent debt are lower than each and every pre-pandemic year.

The CFPB’s recent blog post warns that these recent changes “may push consumers into persistent debt,” yet the CFPB’s 2023 CARD Act Report also addresses persistent debt and finds that rates of persistent debt are lower than each and every pre-pandemic year.