press release

CBA Statement on Community Reinvestment Act Final Rule

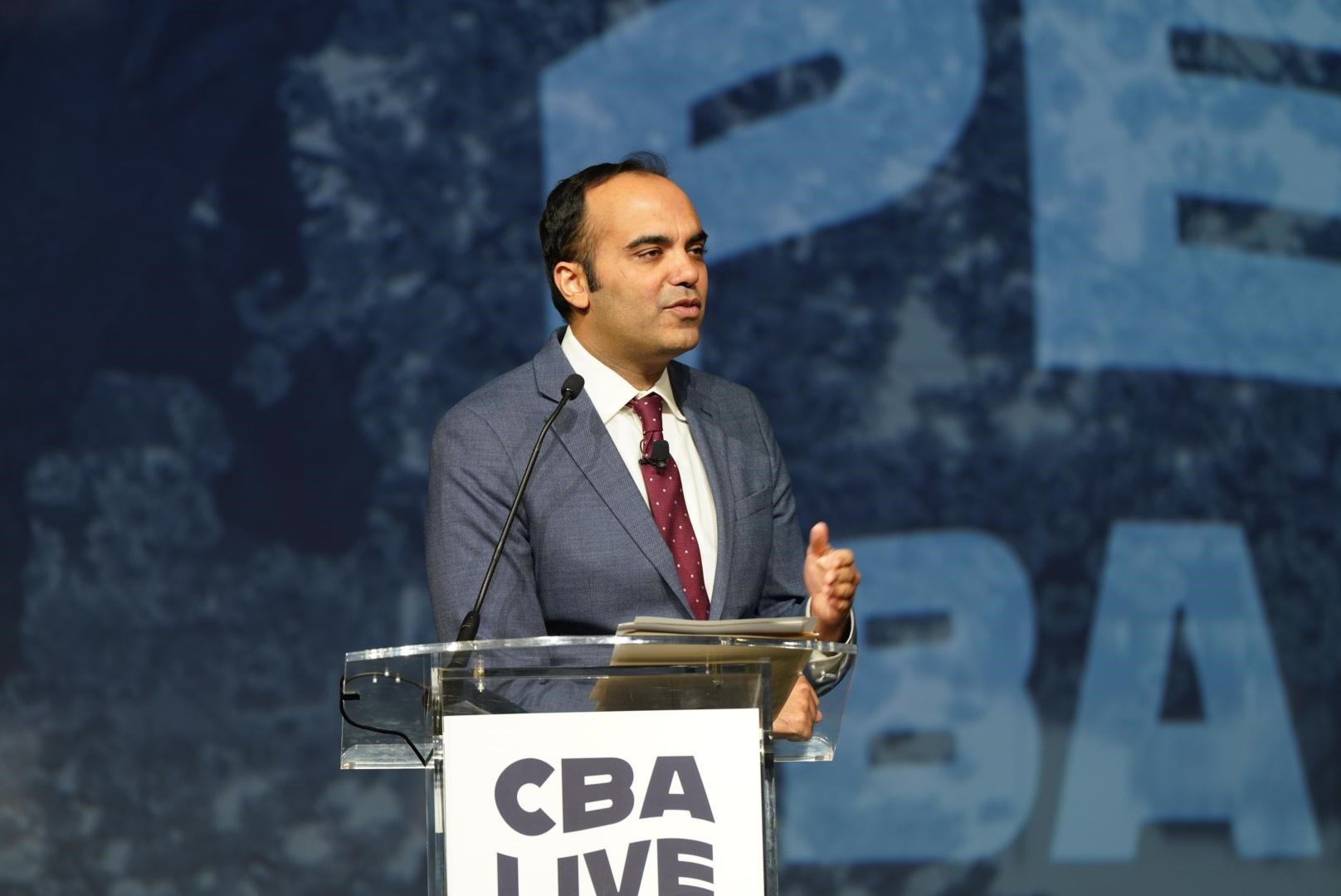

Weston Loyd

Consumer Bankers Association (CBA) President and CEO Lindsey Johnson today released the following statement after the Office of the Comptroller of the Currency (OCC), the Board of Governors of the Federal Reserve System, and the Federal Deposit Insurance Corporation (FDIC) released a joint final rule to amend the Community Reinvestment Act (CRA) regulatory framework.

“America’s leading banks reinvest nearly $1 trillion back into their communities every couple of years under CRA alone – more than any other sector in financial services and more than any other industry. As such, CBA members remain fully committed to expanding access to credit among underserved communities and have re-doubled their efforts to address inequities and provide more pathways to economic growth.

“CBA has long supported the goals of CRA and efforts to modernize this important law to ensure the policy better reflects today’s banking landscape. We appreciate the attempts by the agencies to bring clarity and transparency to how banks are evaluated under CRA requirements. We also support the formalization of some metrics, clearer Community Development Definitions, excluding consumer credit cards from the rule, and a longer implementation timeline.

“At the same time, some of the updates to the CRA could unintentionally impact the consumers we are all trying to help. We urge regulators to take a hard look at compliance burdens give the complexity of the new rule. America’s leading banks remain committed to investing in the communities that need it most and will work to comply with the final rule.”

Background

America’s leading banks invest nearly $1 trillion in low- and moderate-income communities every year through CRA programs. Additionally, many banks made additional voluntary investments in minority communities during the pandemic as these communities were more likely to experience the adverse effects of the Coronavirus. Banks have always been proud partners in complying with other extensive rules and statutes intended to prevent discrimination such as the Equal Credit Opportunity Act and Fair Housing Act. Although America’s leading banks are committed to investing in low- and moderate-income communities, CBA has some additional concerns regarding the Retail Lending Assessment Areas, which will add unnecessary burdens on banks and could result in reduced lending. The rule also makes it substantially more difficult for banks to achieve the ‘outstanding’ rating, and the stricter parameters around facility-based assessment areas are likely to cause banks to unfairly be categorized as needing improvement.CBA Advocacy

- The CRA was first enacted in 1977 and has not been meaningfully updated in over two decades. CBA has long called on policymakers to modernize CRA to better reflect today’s banking landscape and anticipate that of the future. Last year, CBA submitted a comprehensive comment letter in response to the Notice of Proposed Rulemaking (NPRM) on the CRA issued by the Fed, FDIC and OCC.

- CBA’s Community Reinvestment Committee is chaired by Beth Trotter of First Horizon Bank. The committee was formed to advocate for regulatory guidelines that reflect the changing industry, promote coordination between the regulatory agencies involved and the banking industry and facilitate peer-to-peer communication of CBA members. In March, at CBA’s annual event, CBA LIVE, the CRA committee was awarded the second annual Steve Zeisel Committee of Excellence Award, which honors the CBA Committee which demonstrates a steadfast commitment to its mission and goals.

- To learn more about CBA’s recommendations to strengthen the final rule implementing changes to the CRA, click HERE and HERE.